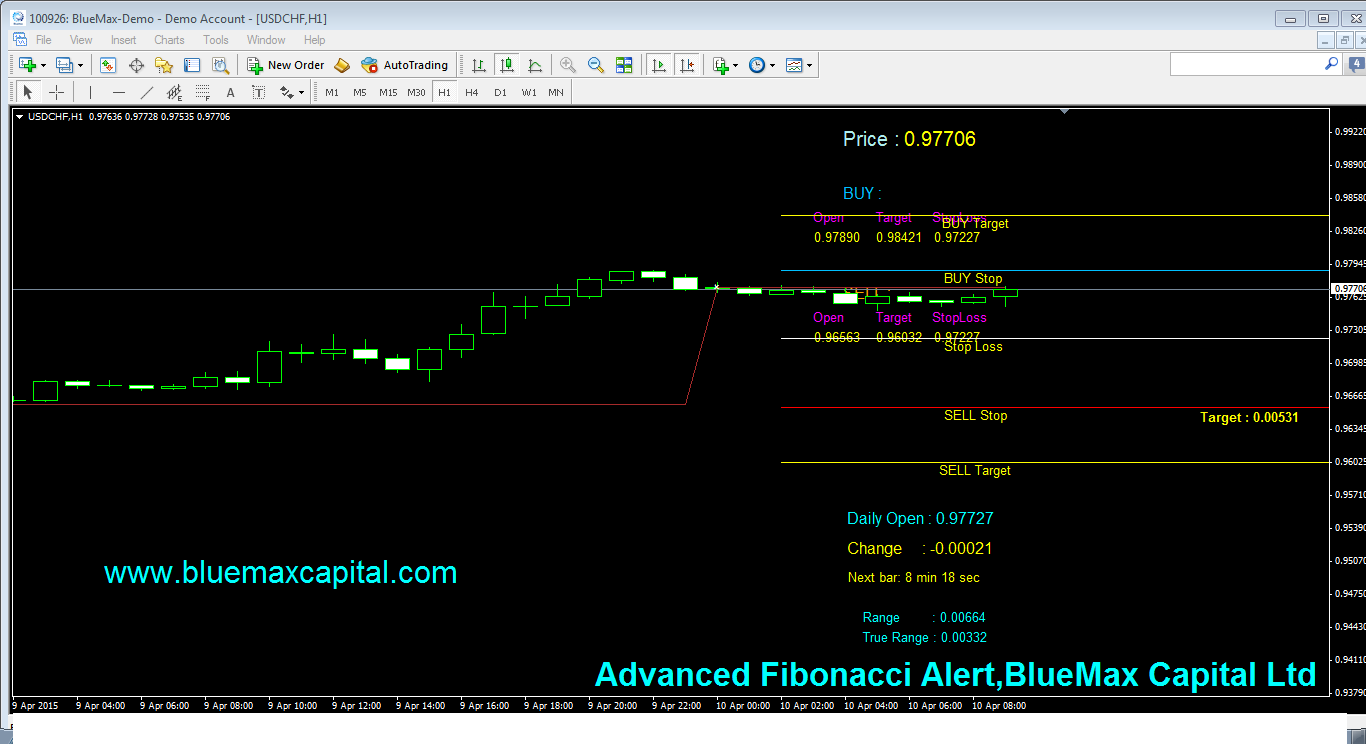

USDCHF Daily articles with advanced Fibonacci alert-source from BlueMax Capital 10/04/2015

At present time USDCHF near to our advanced Fibonacci Buy Stop Line 0.97890.So we expect here perfect BUY Trend. When the market reach 0.97890 we can conform once again our Buy point.

Also today New York session time if USDCHF crossed our given Buy Stop 0.97890 means it will reach the Buy Target point 0.98421 sure .Here we recommend to maintaining the stop loss value 0.97227 to avoid any huger losses suppose market taken reverse order means.

Alternatively if market move to Sell trend means we can use the entry point as 0.96563 and we can place there our exact profit point as 0.96032 by the way of our BlueMax Capital Ltd Advanced Fibonacci tool alert. For sell order stop loss value is 0.97227

Fundamental Analysis:

According to today’s USD currency bank data USDCHF market expecting more buy trend .Because USD “ Federal budget balance” Forecast -43.0B is increase from Previous -192.0B .So all the USDCHF Traders recommend to choose Buy order more .

BUY ORDER DETAILS

|

SELL ORDER DETAILS

|

ENTRY POINT: 0.97890

|

ENTRY POINT: 0.96563

|

TARGET:0.98421

|

TARGET: 0.96032

|

STOPLOSS: 0.97227

|

STOPLOSS: 0.97227

|

Risk Disclosure: BlueMax Media will not accept any liability for loss or damage as a result of reliance on the information contained within this website including data, quotes, charts and buy/sell signals. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. Currency trading on margin involves high risk, and is not suitable for all investors. Before deciding to trade foreign exchange or any other financial instrument you should carefully consider your investment objectives, level of experience, and risk appetite.

BlueMax Media would like to remind you that the data contained in this website is not necessarily real-time or accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore BlueMax Media doesn’t bear any responsibility for any trading losses you might incur as a result of using this data.

No comments:

Post a Comment